rogerbum

Active member

- Joined

- Nov 21, 2004

- Messages

- 5,934

- Reaction score

- 3

- C Dory Year

- 2008

- C Dory Model

- 255 Tomcat

- Vessel Name

- Meant to be

starcrafttom":39hd6cs0 said:That we should tax all wage earners equally? E.g. should the wage earner making only say $20,000/year be taxed at the same RATE as those making much more?

Yes!!!!!!!!!!!!!!!!!!!!!!!!! having spent the vast majority of my life earning less then 30k a year and having also been a E1,2,3,and 4( unlike some posters) the answer is yes, yes ,yes

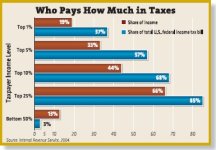

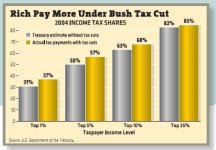

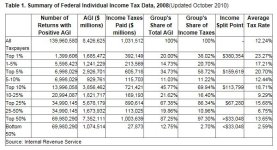

OK - can we start by making sure that those who make way more than you and I pay at least the same percentage of their adjusted gross income in taxes as I do? At present, those making $10M or more per year pay (on average) a smaller percentage of their adjusted gross income in taxes than I do. Also, I wonder how you would have felt about this when you were making very little. A good deal of the difference in tax rate on adjusted gross income between the rich and poor comes from the number of deductions (personal, kids, mortgage, health expenses) that reduces the adjusted gross income down to near zero taxable income for those with very little income. Get rid of those, and the tax rate will become more equal.

As an aside, I actually tried to join the marines when I was 18 and was rejected for medical reasons so the "unlike some posters" comment is a tad uncalled for.